The road to financial freedom is a difficult one. It seems simple, so why has a simple concept become so elusive for most Americans? What stops people from having the financial means to live the life we desire?

America is the wealthiest country in the world. So how is it that half of Americans can’t afford a 500-dollar emergency? How is it that the average debt Americans have on credit cards is between 4,000 to 6,000 dollars? How can the wealthiest country in the world have this financial reality and not consider this an issue? How can America’s future be bright and healthy if the economic situation for half the population is living paycheck to paycheck?

While there are a multitude of factors that play a hand in this, the topics that will be discussed are wealth distribution, wage stagnation, predatory lending and the lack of financial education in more detail below.

Wealth Distribution

The wealth distribution in America is vast. The top 10 percent of earners in America have more than 50 percent of total share of wealth. The bottom 50 percent have less than 3 percent of the total wealth.

The graph above shows that most wealth in America is concentrated in a small cohort of the population. Remember, half of America can’t afford a 500-dollar emergency, so it would make sense that 50 percent of Americans have, essentially, no wealth.

But what is wealth? What is the difference between wealth and income?

To quote investopedia, “Wealth measures the value of all the assets of worth owned by a person, community, company, or country. Wealth is determined by taking the total market value of all physical and intangible assets owned, then subtracting all debts. Essentially, wealth is the accumulation of scarce resources.

Specific people, organizations, and nations are said to be wealthy when they are able to accumulate many valuable resources or goods. Wealth can be contrasted to income in that wealth is a stock and income is a flow, and it can be seen in either absolute or relative terms.”

Wealth is different than income in that wealth is value that you are storing through ownership of assets, whereas income is just money or assets that are being received or given, hence a flow. If income is earned but is spent to purchase concert tickets or used to pay loans, that isn’t building wealth. If you have 5k in your savings account but 20k credit card debt, that isn’t wealth building; 5 – 20 = -15.

This brings us to, not only the amount of debt you have to pay off, but what kind of debt you have as well. If you have money in a savings account, lets say 10k, but you owe 30k in debt, you are still negative on the wealth scale. However, if you are buying property, stocks, or bitcoin that’s a different story. These assets tend to retain value better than putting your money into a savings account or under the mattress. Owning assets, not liabilities, gives one the ability to sell them in the future for a profit, since they retain their purchasing power.

Not to go too off topic, but the dollar isn’t a great store of wealth over a long time period. The dollar is the strongest currency in the world, it is the world’s reserve currency, yet, due to inflation, it loses its purchasing power over time. Assets like Bitcoin or real estate tend to increase in value over time. It is outside the scope of this article, but let us just say people value these assets enough where they’re willing to spend more on them, over time, to own them. Building wealth isn’t just about earning a lot of money. It is also about retaining purchasing power for potential use in the future.

Wage Stagnation

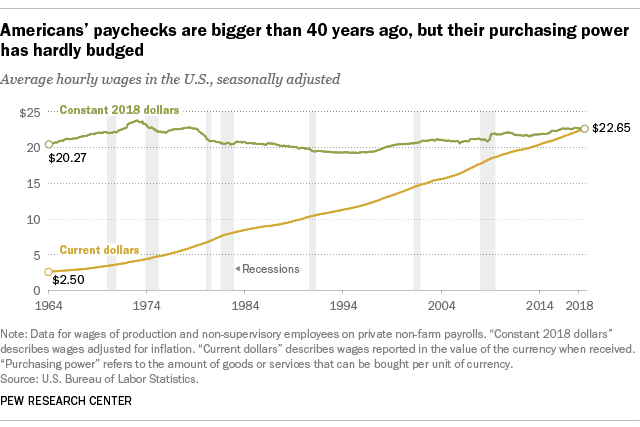

Wages in America, when factoring for inflation, have barely risen since the 1970’s. This means that, roughly, for the last 50 years, the purchasing power of households, on average, has not increased.

Why this is an issue becomes obvious once one considers the cost of goods and services. Commodities, like gas, food, etc. have become more expensive, especially in these inflationary times. All the above, combined with the dollar going off the gold standard in 1971 and the quantitative easing (money printing) since 2008, has led to the average American being drained of wealth and strained to keep up with the rise in cost of living.

What becomes frustrating to stomach is that if you were born in the last 20 years you are faced with a bleak financial future. Housing costs have risen, and continue to rise, whether you rent or have a mortgage on a home. Stocks have become over-saturated and overvalued, leading to constant financial bubbles that inflate and then burst. In the last 30 years you have the dot.com bubble and the housing bubble that burst and we are in a current downturn that some call “the everything bubble.”

Purchasing power from income, as discussed above, has remained stagnate for the average american since the 70’s. Savings accounts and bonds, at the time of this writing, are negative yielding, meaning you aren’t beating inflation, you are just losing purchasing power slower than if you kept it under the mattress. And, finally, you will have lived through two major economic recessions and a global pandemic that hasn’t been seen since the appearance of the Spanish flu during World War One.

An optimist might say that this just means that the markets are resetting themselves and that a new era of prosperity is in the horizon, but personally, I don’t think so. There will be some good years ahead, sure, there is always a rebound. The question is the overall trajectory for the average American? If the last 50 years is any indication, it going to be stagnate, at best, or, worse, slowly decreasing into a fading sunset.

Predatory Lending

There is a strange set of rules for how lending works in America. The ability to get loans that are favorable or good for the individual are for those that are already better off. Starting out on the road to financial freedom, you will experience first hand how you are punished for no reason. For instance, if you are young and want to get a used car loan, banks have a higher loan rate if it is your first time applying for this type of loan. This example is something I experienced personally.

I had good credit, low debt (only student loan debt) and the lowest rate I could get was 8% APR. My issue was that the lowest rate they offer was 3% APR, but being that I never had a loan of this type in my credit history, I wasn’t eligible for the lowest rate possible; I was put into a different tier. I was forced to pay a high rate.

Another instance, was when I was looking to get a personal loan. I went to a couple of local banks in my area and tried to apply for a loan. What I discovered was that it was impossible for me to do so. I still had good credit, but that didn’t matter. Most of them only would offer me a loan if I was home owner, then I could take out a loan with my house a collateral, but since I didn’t own a home, there was nothing they could offer me.

One bank did have a option for a loan, but it really wasn’t a loan that would be of use to me. Essentially, it was a loan where the bank didnt take any risk. As an example let’s say I wanted a loan for 1000 dollars. I would give the bank 2000 dollars and then the bank would use that 2000 dollars as collateral for the 1000 dollar loan. In other words, I would be able to get the 1000 dollar loan by loaning the money to myself and then pay myself back over time. The bank would charge me a “low rate” of 3% for loan.

Obviously, since I had good credit, this wasn’t useful. This type of over-collateralized loan could be useful if I had bad/no credit and wanted to improve my credit score, but, again, if I have good credit what’s the point?

The only way to get a personal loan, since I have no assets to use as collateral, is through the use of credit cards. Of course, in the case of a used car loan, or a new car loan, there are options to get access to a loan. However, if you have no stated purpose and want to use it under your own discretion, then using a credit card is the only option that made sense, in my experience at least. Bigger banks do have the ability to give out personal loans, but when I looked at the interest rates, it just didn’t make financial sense to go through with it. Also credit cards are associated with these banks and, depending on what you are trying to do, going through a credit card offer a better option to taking out a loan directly from a bank.

The reason credit cards are willing to give you a loan against your credit limit is because they want you to screw up and get stuck paying a high APR. Now, you can get a deal where they will give a zero percent interest loan for 12 months and that can be a great option; if you can pay it off in the allotted time frame.

The credit card loan, by itself, isn’t the problem. The problem is that they know many people will fail to pay everything back in time and then get stuck paying high interest fees. Again, the average American has between 4-6k in credit card debt, and if one carries a balance, and doesn’t pay the credit card off fully, the fees are exorbitant. They can be anywhere from 15 to 30% in interest payment fees, which traps people into debt they cannot afford to pay off.

The credit card companies already charge a 3-4% on all your purchases. This isn’t a cost the credit card holder has to deal with, they instead charge this convenience fee to the businesses that sell you goods or services. This can help explain how they can afford to give you that one or two percent cash back on your purchases and/or when you pay off your balance on your account.

And this needs to be repeated because this is what makes credit cards so finanacially dangerous. The real money maker is when you can’t pay the credit card company back the money they lend you. They make the big money when you carry a balance every month. Credit cards are meant to have you take out more than you can afford and then they bury you in late payment interest fees. They aren’t looking out for you, they want to give you more than you can afford to lend.

My issue with lending is that if half the country as no wealth to speak of, how are people supposed to get a loan that helps them achieve financial prosperity? If you have bad credit, the system is designed to make it even more likely you can’t pay back any loans you take out or are living paycheck to paycheck to survive paying off the loans.

The system punishes younger people or someone with no credit history by charging people higher rates simply because they do not have a long history with using credit. In the case of a young person, that is something that is impossible to control. Plus, young people, because they are beginning their work careers are likely not making a lot of money to begin with, triggering the spiral of living paycheck to paycheck and making it more likely that they have no money to invest in assets to start the wealth building process.

America needs to reform a system that makes lending accessible and not financially dangerous to do so. We can’t just give people free money, that isn’t what I am arguing for. Yet, if the only realistic way to get money you don’t have, but do need, is through a credit card system trying to trap you in debt, how can we expect the wealth gap to improve back to acceptable levels?

Financial Education

Take a moment and reflect back on your time in the education system. Tell me about the time where you learned how to make a budget, how to write a check, how a 401k works, how to apply for a loan, etc. My guess is you never learned about those in school.

The lack of financial education we make mandatory for children during thier formative years is appalling. Whether you are a high school drop out or go on to earn a PhD, an understanding of how to manage one’s finances is necessary. Personal finance is one of the few topics that everyone can benefit from because we all become adults and have to learn how to pay the bills for goods and services we want and need.

I am not claiming to be a financial advisor, but why do we not attempt to educate and prepare our children and therefore, society, on how to handle thier finances? Why do we not discuss how to save for retirement and, more importantly, the generally accepted methods to do so. Why don’t we teach people how credit cards work BEFORE they get them and max them out?

America has issues, most wouldnt say that’s a controversial statement. Yet, wouldnt the most neutral, bipartisan, way to help every American be to make sure we all understand the basics of how money and personal finance works? Would it not make more sense to make sure every American can make a plan on how to be financially self-sufficient or know what they need to do to one day become self sufficient. Also would it not be a good thing for a democratic society to understand how to balance a budget and be able to understand the cost of political/economic decisions?

All I know is this. If we keep going off the same playback we have been using the last 50 years, things aren’t going to stay the same. They will get worse.